📊 Structured Products – Tailored Investment Solutions

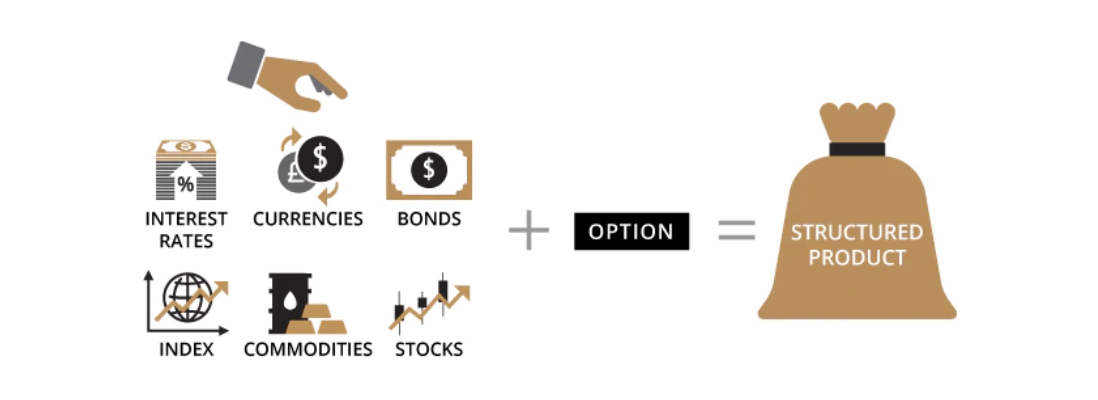

A structured product is a pre-packaged investment strategy that typically includes a combination of financial instruments such as derivatives, stocks, bonds, or other assets. Structured products are often designed to meet specific investment goals, such as capital protection, enhanced returns, or market exposure. These products are customized to fit the needs and risk tolerance of investors.

🔑 Why It's Important:

- Customization: Structured products allow investors to tailor investments based on their risk preferences, time horizon, and financial goals. This flexibility makes them attractive for those seeking specific outcomes.

- Market Access: They can provide exposure to various asset classes, markets, or strategies (e.g., foreign currencies, commodities, or emerging markets) that may not be easily accessible through traditional investments.

- Risk Management: Some structured products offer a level of capital protection, which means investors can limit losses while still benefiting from potential market upside.

🌟 Benefits of Structured Products:

- Capital Protection: Some structured products, like principal-protected notes, offer a degree of capital protection, meaning the investor may get back at least their initial investment, even if the underlying asset performs poorly.

- Enhanced Returns: Investors can potentially earn higher returns than traditional investments by using leverage or linking the product's return to the performance of a basket of assets or an index.

- Diversification: Structured products can provide exposure to a broader range of asset classes, sectors, or strategies, helping to diversify a portfolio.

- Flexibility in Risk/Return Profiles: Investors can choose products with varying degrees of risk, from low-risk options with capital protection to high-risk, high-reward options that depend on market performance.

- Tailored to Specific Needs: Structured products can be designed to meet very specific needs, whether it's income generation, capital growth, or even tax optimization.

- Hedge Against Market Volatility: Certain structured products can be used to protect against market downturns, providing more stability in turbulent times.